Preparing For Rough Times Ahead

|

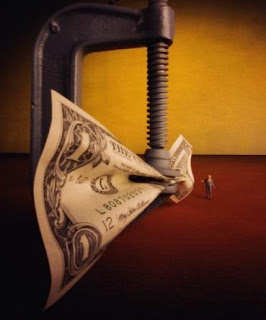

| Credit Crunch |

Banks are cutting back, even on accounts held by their most credit worthy customers. Credit lines are being reduced, and interest rates are being raised, even for certain borrowers who've never been late with a payment. The excuses the banks are using these days include, "You aren't paying down your credit card balance down fast enough," and, "Your debt to credit limit ration is too high." Banks are even looking at the what consumers are buying when determining whether or not the consumer is going to be hit with an unfavorable change in terms. In other words, your credit card company may change the terms and conditions on your credit card account simply because it doesn't like what you are buying!

I have about $4,000 worth of business-related credit card debt on one business credit card; it's an account with which I'm still riding out a introductory zero APR period, so I'm not getting slammed with interest charges. I'm worried about the state of the U.S. economy and the state of my business. Business has been slow, and I'm thinking that I may have to tap into more credit lines to keep things going. I receive a lot of snail-mail credit card offers each and every week, and many of these offers are for business credit cards. I usually glance through these offers quickly then dump them into the shredder. Lately, however, I've been paying very close attention to these offers, since I just might open up one or two more credit accounts.

I'd like to transfer the $4,000 balance on my current business credit card to a new card with a 0% balance transfer offer, so that I can continue to finance my operations without paying any interest. However, lately, the deals I've been getting via snail mail haven't been that great, and I'm certain the reason these recent offers have been lousy is due to the weak economy in cahoots with the credit crunch. This is very disappointing to me, because, historically, those snail mail credit card offers included the most consumer-friendly credit terms and conditions. It was not too long ago that I was seeing offers of 0% intro APR on transferred balances for 15, with no balance transfer fee. Here's what I've been seeing lately:

A business credit card offer from Bank of America - 0% intro APR on transferred balances and balance transfer convenience checks until December 31, 2008, with a balance transfer fee of 3% (minimum transfer fee is $10.) Once the interest-free period ends, the APR converts to the standard purchase APR on this particular account, which is fine. But here's the kicker: the balance transfer fee "will post to your account as a cash advance fee and will receive the Standard cash advance rate." So, in other words, if I transfer $4,000, I'll be charged a balance transfer fee of $120, and that $120 will be treated as a cash advance. You probably already know this but cash advance fees are always very, very high. For this particular card it's a minimum of 19.99%. This offer was shredded real fast.

A business credit card offer from Bank of America - 0% intro APR on transferred balances and balance transfer convenience checks until December 31, 2008, with a balance transfer fee of 3% (minimum transfer fee is $10.) Once the interest-free period ends, the APR converts to the standard purchase APR on this particular account, which is fine. But here's the kicker: the balance transfer fee "will post to your account as a cash advance fee and will receive the Standard cash advance rate." So, in other words, if I transfer $4,000, I'll be charged a balance transfer fee of $120, and that $120 will be treated as a cash advance. You probably already know this but cash advance fees are always very, very high. For this particular card it's a minimum of 19.99%. This offer was shredded real fast.- Snail mail business credit card offer from Washington Mutual Bank (WaMu) - 0% intro APR on transferred balances until August 1, 2009 -- that's 13 months! The balance transfer fee is 3% of each transferred balance, with a minimum transfer fee of $5. The "go to" APR -- the APR the remaining transferred balance would be subject to once the interest-free period ends -- would be the Standard purchase APR, which happens to be a reasonable and competitive 9.99%. And, once again, here's the ugly part: "Balance transfer fees are added to the purchase balance and are subject to the APR for purchases." OK, granted, this is better than the Bank of American offer I described above where the balance transfer fee is treated as a cash advance, but I'm still not buying it. My credit rating is very high and I see no reason why I should have to pay finance charges on a balance transfer fee, like I'm some sort of subprime borrower. If the offer is stellar, then I don't mind paying a balance transfer fee, as long as the fee is a one-time, flat fee with no finance charges attached.

I'm not interested in transferring my business card balance to a consumer card, even though I'm very confident that I could find a better deal than the recent business credit card offers I've seen. I've worked very hard to get my FICO® credit score above 800, and transferring thousands of dollars to a new or existing consumer credit card would bring my score down.

That's all I have to report from the wonderful yet perilous world of credit card balance transfers for now. Stay tuned!

Labels: balance_transfer_fee, bank_of_america, providian, wamu, washington_mutual

|

--> www.FedPrimeRate.com Privacy Policy <--

> SITEMAP < |

<< Home