People are starting to wonder about Bank of America, specifically Bank of America's credit card offerings. For some time now, I've been reading lots of posts about MBNA's poor customer support and questionable tactics, and I wasn't a bit surprised to eventually find that thousands of MBNA credit card holders had started paying off their entire credit card balances and closing their accounts in order to permanently sever their relationship with MBNA. MBNA's profits were hit hard by the exodus, leaving MBNA primed for a takeover, and that's exactly what happened: Bank of America purchased MBNA a few months ago; Bank of America (BofA) obviously looking to capitalize on the millions of credit card accounts owned by MBNA.

But now many are saying that Bank of America has adopted some of the worst behaviors that were the cause of much anguish for MBNA's credit card account holders.

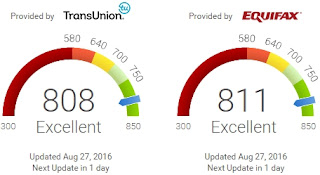

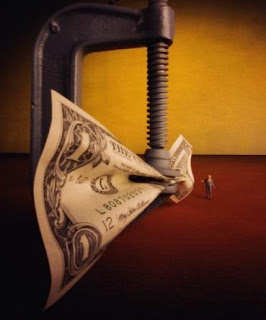

One particular complaint really caught my attention. A mature lady with a very good personal credit rating decided to take advantage of a Bank of America 0% balance transfer offer. The lady described herself as person who always pays her bills on time and who never carries a revolving balance on her credit cards. This lady soon found that she was being charged some hefty over-the-limit fees on her BofA account, even though she did not have a balance on her credit card (and she was making regular and timely installment payments related to the balance transfer deal.) When she called BofA to find out why she was being charged over-the-limit fees even though she was making her payments on time, the BofA explained that:

...even though [she was making] payments during the month to keep the balance within the credit limit, there could be a day within the cycle that the card was officially “over the limit.”

To further exacerbate the situation, she was charged $451 in interest charges, even though it was supposed to be a 0% balance transfer deal. Why was she paying interest on a 0% deal? Because her interest rate had gone from 0% to 31% as a result of a violation of the BofA credit card agreement. And this is the part of this story where you really need to pay attention; here are the terms that caused the interest rate to skyrocket:

"During the introductory period, if we do not receive at least the Minimum Payment Due during any billing cycle, you exceed your Credit Limit or you close your account, any introductory rate on Purchases and Balance Transfers will terminate and will be adjusted to the Standard Rates."

Do you see what is going on here? If you don't, allow me to explain.

It is perfectly legal for BofA to charge over-the-limit fees and interest on the above-described account. You see, this is one way of playing the 0% balance transfer game that can result in huge profits for the credit card company involved. Is it wrong for credit card companies to engage in such tactics? You decide.

Allow me to present a hypothetical 0% credit card balance transfer offer from the fictitious Balance Transfer Bank of Anytown, USA. The 0% balance transfer offer is very competitive, offering an introductory interest-free period for 18 months, with a balance transfer fee equal to 3% of the transferred balance, or $75 (whichever is lower.) The terms for this credit card offer are quite ordinary, and include the following clause:

"During the introductory period, if we do not receive at least the Minimum Payment Due during any billing cycle, you exceed your Credit Limit or you close your account, any introductory rate on Purchases and Balance Transfers will terminate and will be adjusted to the Standard Rates."

OK. So you decide that it's a great deal and you are going to go for it. After all, you have some high balances on some of your other credit cards, and the interest charges are really starting to hurt! You call the toll-free number provided to apply. You tell the representative on the phone that you would like to take advantage of the 0% balance transfer facility, and that you want to transfer $5,000 from one of your other credit card accounts to your new Balance Transfer Bank credit card--assuming that you get approved for the card, of course. The representative on the phone informs you that you have been approved for the new credit card and that you've also been approved for the $5,000 balance transfer. Cool! Everything seems to be going your way. The representative doesn't tell you what the credit limit on your new card is going to be, so you decide to ask. The representative tells you that he doesn't know what your credit limit will be, but you will receive a letter in the mail with all those details within 2-3 weeks.

A week later you get a letter from The Balance Transfer Bank of Anytown, USA. The purpose of the letter is to congratulate you on your approval status, and to let you know that your credit limit is $5,000. OK, no problem. You're transferring $5,000, and your limit is $5,000. All the math works out fine!

Two months later, you get a credit card statement from The Balance Transfer Bank, and you see that you've been charged an over-the-limit fee of $29. You also notice that the interest rate on the $5,000 you transferred has gone from 0% to 29%, and you are already accruing interest charges on the balance you transferred. All this and you have never used the card to make any purchases or cash withdrawals. Why did this happen?

It happened because The Balance Transfer Bank decided to set your credit limit to exactly $5,000--which is the exact amount you transferred with the 0% balance transfer offer. And here's the best part: the $75 balance transfer fee caused your balance to jump from $5,000 to $5,075, thus giving The Balance Transfer Bank every right to charge you for being over your credit limit. More bad news: because you violated the credit card agreement by going over your credit limit, your interest rate on the $5,000 your transferred has gone from 0% to 29%.

The scenario I've just described above is happening to folks around the country every day. MBNA was doing it, and it most likely contributed to their downfall. But Bank of America? Why would they adopt such tactics? It doesn't make sense! Surely they must know that they are going to scare away customers. Sure, it makes them some great profits in the short term, but what about the long term? Doesn't it make more sense to focus on retaining their customer base for the long haul by treating their customers fairly? Hmmm...

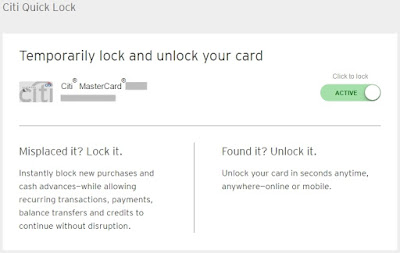

Just last week, I signed-up for a new Citibank

credit card and took advantage of an associated 0% balance transfer offer. I asked about my credit limit, and even though the Citibank representative wasn't able to tell me what my limit would be right away, he did assure me--in fact he guaranteed--that my limit would be set to a level that is higher than the balances I was transferring, so that there would be some room to accommodate any fees that might be assessed. And that's the way it should be. A Chase representative I spoke to a few months ago said basically the same thing.

I feel that it is very important for me to note here that I've had a Bank of America Gold credit card for over 2 years now and I've had no problems with it. To be perfectly honest, it's one of the best credit cards in my wallet. I took advantage of a Bank of America 0% balance transfer offer in order to obtain the card and it was a very good deal. Flawless. No problems. It's the only credit card I own that has a picture of my baby girl on it. Over the past two years the good folks @ Bank of America have not only lowered my interest rate, but they've also given me a generous credit limit increase (both actions look great on a credit report.) So I can write here with complete sincerity that I am really confused about the latest buzz about BofA credit card offers.

The Bank of America grew from a small Italian bank into the American icon that it is today by providing their customers with superior support and service. Let's hope that the acquired MBNA tactics related to their credit card offerings are just a hiccup, and that in the very near future they'll be back to providing some of the best credit card deals around.

Labels: bank_of_america, credit_card_review, mbna, zero_percent_balance_transfer

A business credit card offer from Bank of America - 0% intro APR on transferred balances and balance transfer convenience checks until December 31, 2008, with a balance transfer fee of 3% (minimum transfer fee is $10.) Once the interest-free period ends, the APR converts to the standard purchase APR on this particular account, which is fine. But here's the kicker: the balance transfer fee "

A business credit card offer from Bank of America - 0% intro APR on transferred balances and balance transfer convenience checks until December 31, 2008, with a balance transfer fee of 3% (minimum transfer fee is $10.) Once the interest-free period ends, the APR converts to the standard purchase APR on this particular account, which is fine. But here's the kicker: the balance transfer fee "